1222

1222

This article will explain what each Set transaction type can adjust within your borrower's payment account. There are 3 transaction types that are labelled as Set:

- Interest Rate

- Payment Amount/Type

- Non Accrual Status

Set Interest Rate

- Set Interest Rate can adjust anything related to interest rate. You can change the account from Fixed interest rate type to Variable interest rate type, or you can adjust the actual interest rate on the payment account per the specified effective date.

1. Effective Date - enter the date you want this adjustment to be effective. Remember, if the date is before the date of another transaction on the borrower's account, you may need to delete/void out those transactions to post the adjustment. ***Required Field***

FIXED

2. Rate Type - Fixed means the rate is not adjusted or tied to an adjusting index. ***Required Field***

3. Fixed Rate- the interest rate of the loan. ***Required Field***

4. Basis (same for both Fixed and Variable) - set the accrual method. ***Required Field***

VARIABLE

2. Rate Type - Variable means the rate adjusts based on specified index and possible spread. ***Required Field***

3. Spread - the margin that will be added to the base to create effective rate of loan. ***Required Field***

4. Rate Index - a benchmark index that defines the Base Rate. ***Required Field***

5. Base Rate - a benchmark interest rate added together with spread to create effective rate of loan. ***Required Field***

Set Payment Amount/Type

- Set Payment Amount/Type can change the scheduled payment amount due from the borrower, it can reamortize the payment amount, and adjust the payment type (Interest only payments changing to P&I payments).

1. Effective Date - enter the date you want this adjustment to be effective. Remember, if the date is before the date of another transaction on the borrower's account, you may need to delete/void out those transactions to post the adjustment. ***Required Field***

PRINCIPAL & INTEREST / FIXED PRINCIPAL

2. Payment Amount - the scheduled payment amount due from borrower. ***Required Field***

3. Payment Type - Princpal & Interest/ Fixed Principal is the type of payment and allocation of that payment due from the borrower. ***Required Field***

4. Payment Frequency - how often the payment is due from the borrower. ***Required Field***

5. Calculate Payment - press this button to reamortize the payment amount.

INTEREST ONLY

2. Payment Amount - locked field showing the system-calculated Interest Only amount. ***Required Field***

3. Override Payment Amount - select this box if you would like to enter in your own Interest Only payment amount due, and not allow Payments to calculate it for you.

4. Payment Type - Interest Only is the type of payment and allocation of that payment due from the borrower.***Required Field***

5. Payment Frequency - how often the payment is due from the borrower. ***Required Field***

6. Calculate Payment - press this button to calculate the Interest Only payment amount.

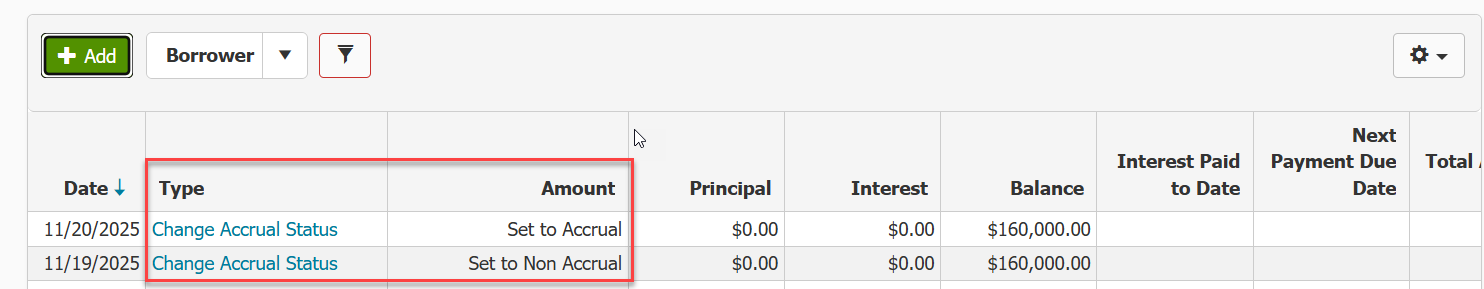

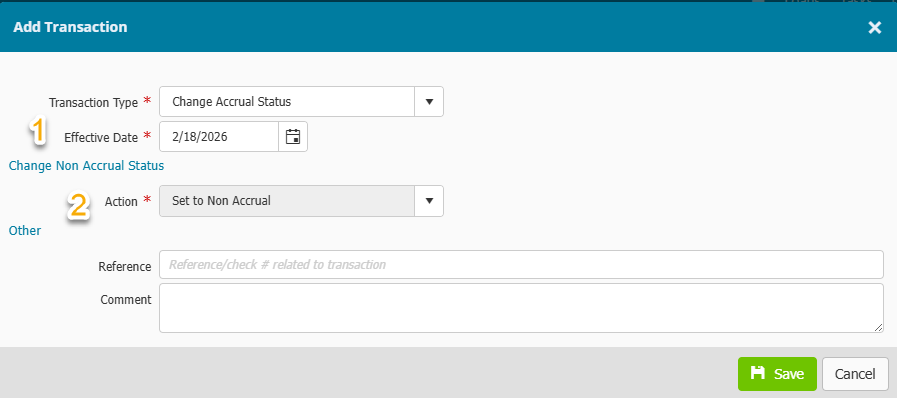

Change Non Accrual Status

- Change Non Accrual Status enables the payment account to be on non accrual. You can report and filter reports based on this status in the Payments reports. The only way to reverse non accrual status is to delete out the transaction.

- Lenders can now change their payment accounts status from Non Accrual to Accrual without removing any previously posted transactions. Previously, lenders had to remove the original transaction of Non Accrual status in order to remove the Non Accrual flag. This transaction does not perform any Non Accrual/Back to Accrual calculations, it is only an informational status.

1. Effective Date - enter the date you want this adjustment to be effective. ***Required Field***

2. Action - cannot adjust the Action, you are enabling non accrual status. ***Required Field***

The Loan main menu page contains a column that displays if the loan is in Non Accrual Status. Setting a loan to Non Accrual Status will result in the column being ticked. The column may need to be added to the table using the Cog icon. You can find out more about adding columns to grids in the article here.