789

789

VENTURES

Important ETRAN Principal (Business/Person) Updates

ETRAN will be requiring some existing Borrower/Guarantor 1919/1244 questions to be answered for Principals and Secondary Principals. We have updated our code and UI for lenders to answer those additional questions, and will send it to ETRAN with your application submission. Here are the high level ETRAN changes that apply to both 7a and 504 applications:

- 1919/1244 questions required for all Borrower (business/person) and OC Guarantors (exception exporter question is not required for 504)

- Questions required for all Principals and Secondary Principals (business/person):

-

Is the Applicant or if the Applicant is structured as an Eligible Passive Company (EPC) and Operating Company (OC), both the EPC and OC, or any Associate of the Applicant presently suspended, debarred, proposed for debarment, declared ineligible, voluntarily excluded from participation in a transaction by any Federal department or agency, or presently involved in any bankruptcy?

-

Is the Applicant, the OC (if the Application is structured as an EPC and OC), or any Associate of the Applicant the EPC or the OC, or any business owned by them, or any Affiliates (per 13 CFR § 121.301(f)), currently delinquent or have ever defaulted on a direct or guaranteed loan from SBA, or another Federal agency loan program (including, but not limited to USDA, B&I, FSA, FHA, EDA) or been a guarantor on such a loan?

-

Is the Applicant or any owner of the Applicant an owner of any other business? If yes, list all such businesses (including their TINs), percentage of ownership, and describe the relationship on a separate sheet identified as addendum A.

-

Is the Applicant, any owner of the Applicant, or any business owned by them (Affiliates), presently involved in any legal action (including divorce)?

-

- Question required for all Borrowers, Principals, and Guarantors (business/person):

- Is the Applicant or any Associate of the Applicant currently incarcerated, serving a sentence of imprisonment imposed upon adjudication of guilty, or is under indictment for a felony or any crime involving or relating to financial misconduct or a false statement? (if “Yes” the Applicant is not eligible for SBA financial assistance.)

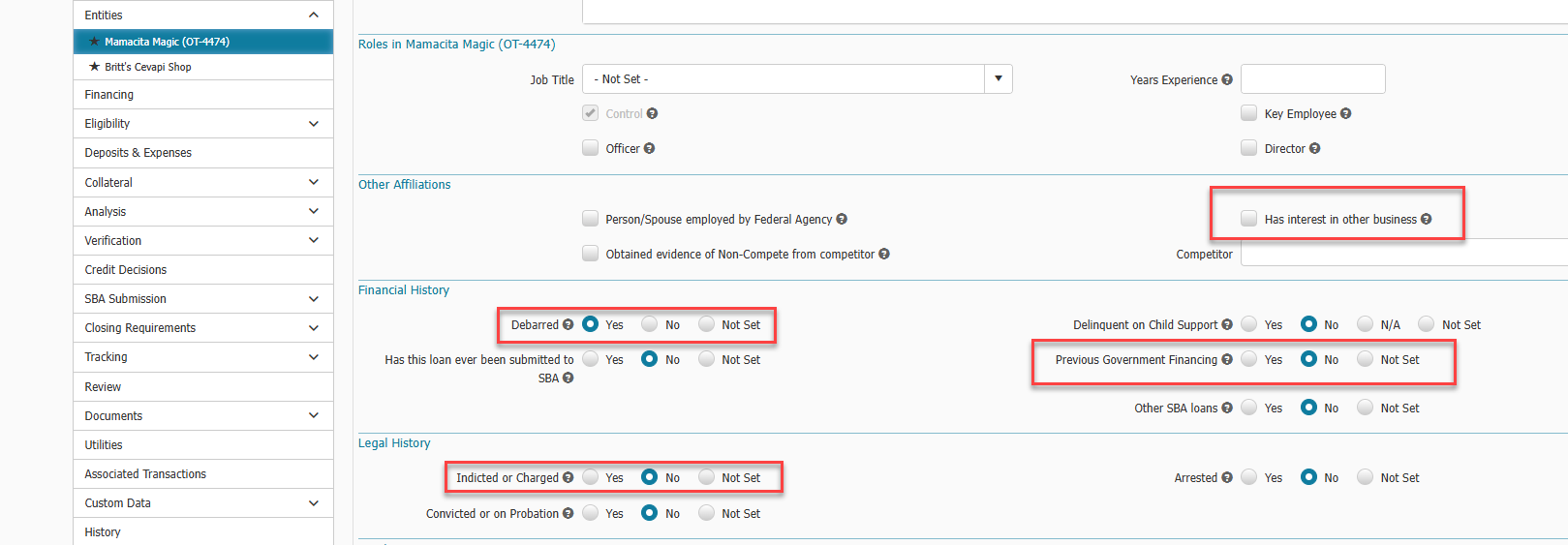

UI Changes for Person Principals

- (504 and 7a) In Entity Contact > General Tab, Other Affiliations section has been exposed for all entity contacts on record. Previously, this section was only visible for specific entity contact types in 7a records and was completely hidden for 504 records.

-

(504 and 7a) In Entity Contact > General Tab, Previous Government Financing and Other SBA Loans fields in Financial History section has been exposed for all entity contacts on record. Previously, it would depend on the contact's company affiliation for visibility.

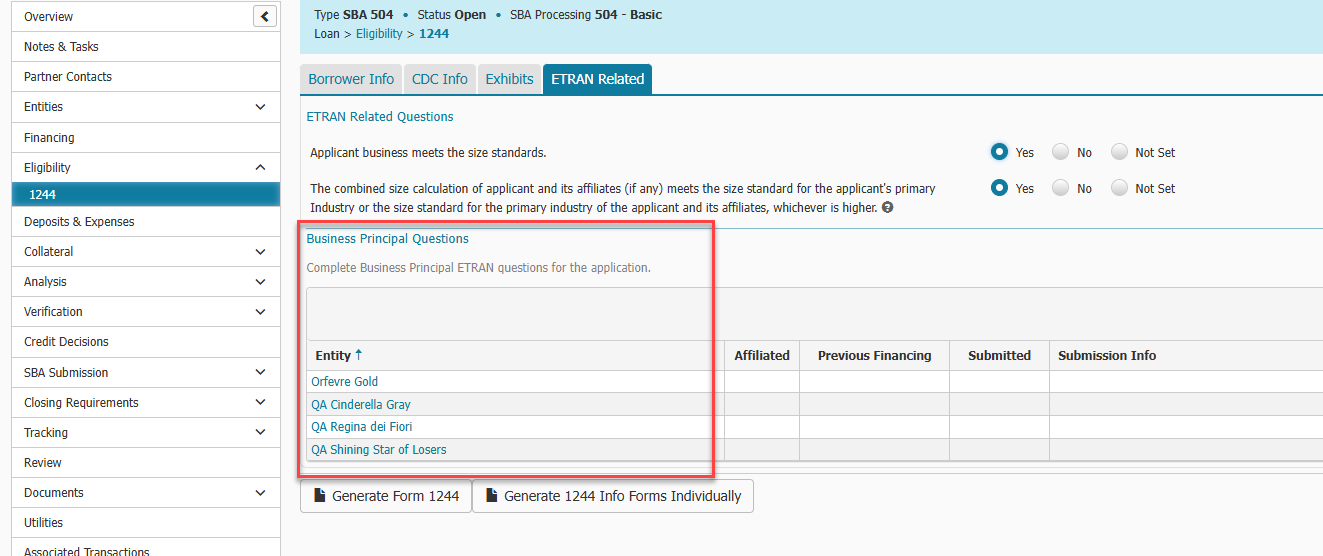

UI Changes for Business Principals

- (504) Entities in a record that are not listed in Eligibility > 1244 > Borrower Info tab, will be visible in new grid in Eligibility > 1244 > ETRAN Related tab. User will answer the Business Principals questions by clicking on the hyperlink name of entity.

- (7a) Users will answer the relative questions in the SBA 1919 tab for Business Principals.

SBA Form 1244 Signature Update

Based on feedback received from our lenders, we made a update to our prepopulating of Authorized Signer. When generating a 1244, it will populate the Authorized Signer in the demographic section at the top of page 2, if the Authorized Signer is an owner with greater than 0% ownership. If the Authorized Signer is not an owner with greater than 0% ownership, it will populate the form with our previous logic.

SBA Form 1253A (Annual 504 Job Information) Update

Per SBA Information Notice 5000-869194, we have updated our generated form to be compliant. You can find our form in Data > SBA CDC Annual Report menu. More information can be found from this link SBA 504 Annual Jobs Report Guide

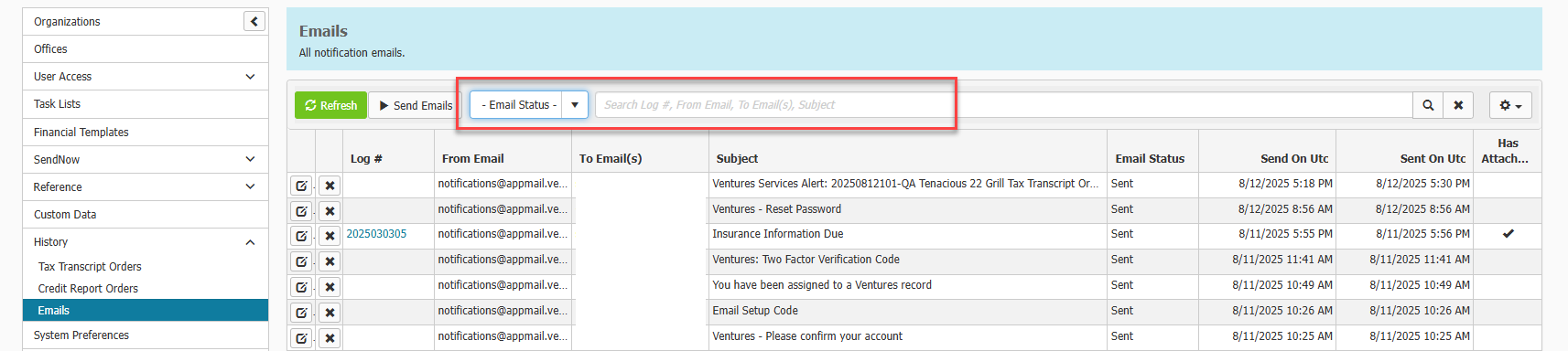

Expanded search capabilities for Site Admins in History > Email

Site Admins can now search by email and filter by email status in the History > Email menu. This will help to filter and review failed emails much easier then before.

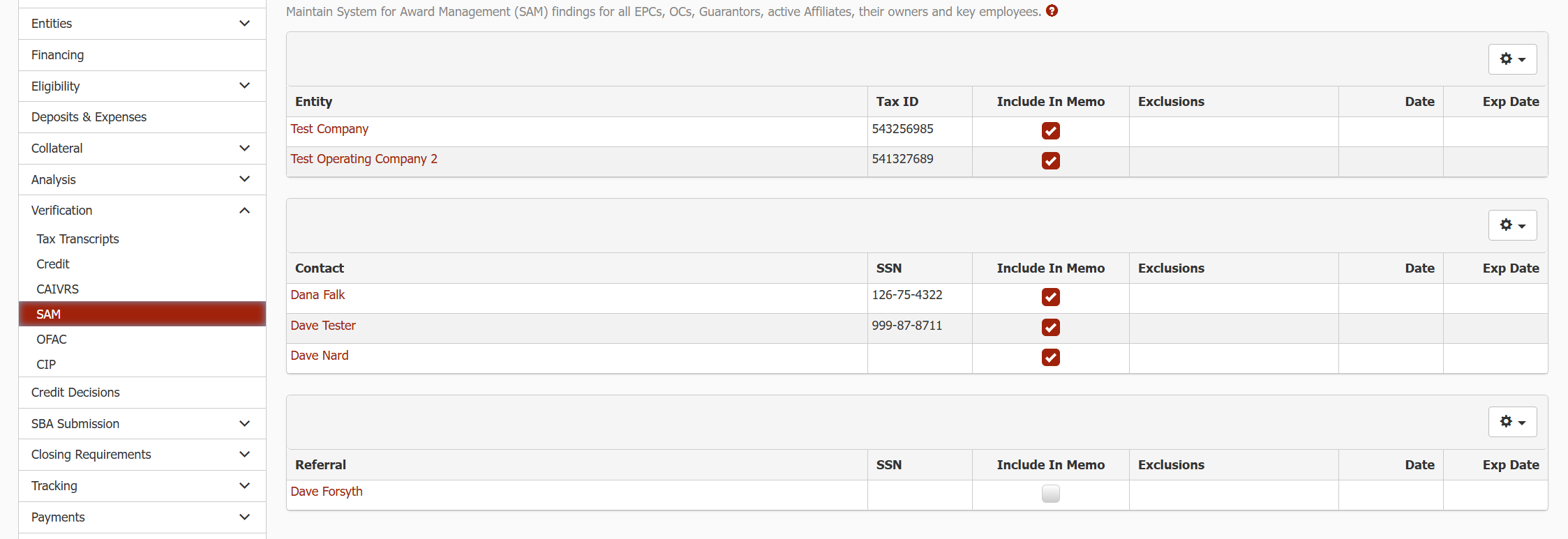

Expanded CAIVRS, SAM, and OFAC List

The CAIVRS, SAM, and OFAC list pages (Loan > Verification) has been modified to include ALL active entities, owners, and guarantors. Lenders may select which are reported on the Credit Memo by using the "Include in Memo" checkbox.

PAYMENTS

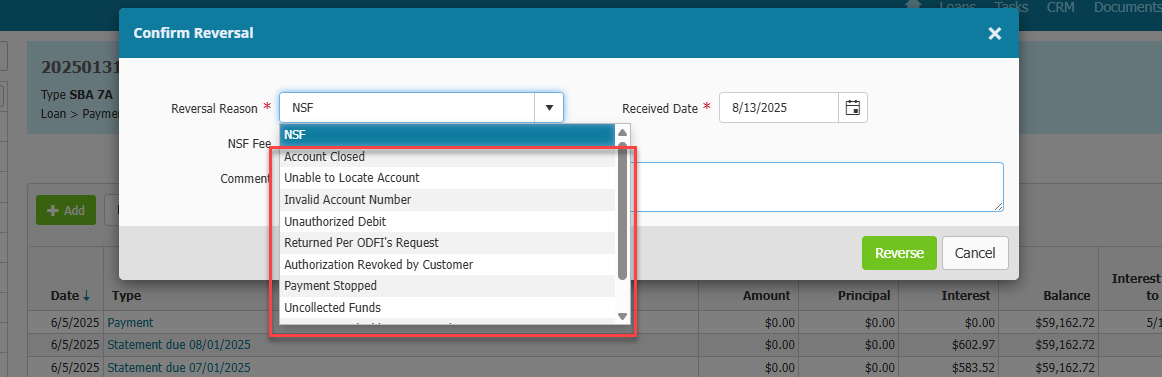

Additional Payment Reversal Reasons added

When reversing a payment, lenders now have more reasons to select for reversal action. Previously, you only had the option of NSF and Other. You can report on these values by adding the Payment Transaction > Reversal Reason field to your custom reports.

Reporting Unguaranteed Amounts

Users can now run reports on the unguaranteed balances and unguaranteed portion of cash received. Previously, users could only report on guaranteed balances and portions. Check out the new system report called Payments: Guaranteed and Unguaranteed Cash Received.

SBA 1502 Report Changes

- Ventures has updated SBA 1502 report version 8/2024 to be based solely on transactions and removed some calculations that previously happened on report generation. This will reduce the number of errors some of our lenders have been seeing the last few reporting months. Thank you for your patience as we made our 1502 better.

- Permanently added Reference Name column with hyperlink to Ventures loan to report.

- Removed "Additional Columns" support for 1502 report version 8/2024. Lenders can use our system report Payments: Guaranteed and Unguaranteed Cash Received to see the unguaranteed information that the columns provided.

- Removed support for the previous SBA 1502 version 12/2023.

- Removed support for the preconfigured PPP 1502 found in the Data > PPP Loans menu.