Oct 28, 2025

136

136

Line of Credit

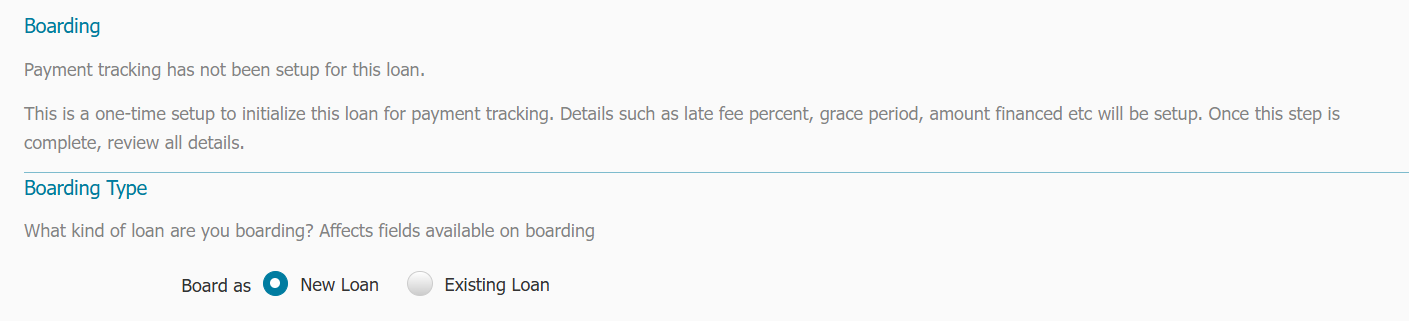

This article will explain how to board a Line of Credit Payment Account. There are 2 ways to board a payment account as a line of credit:

- New Loan

- Existing Loan

Boarding as New Line of Credit

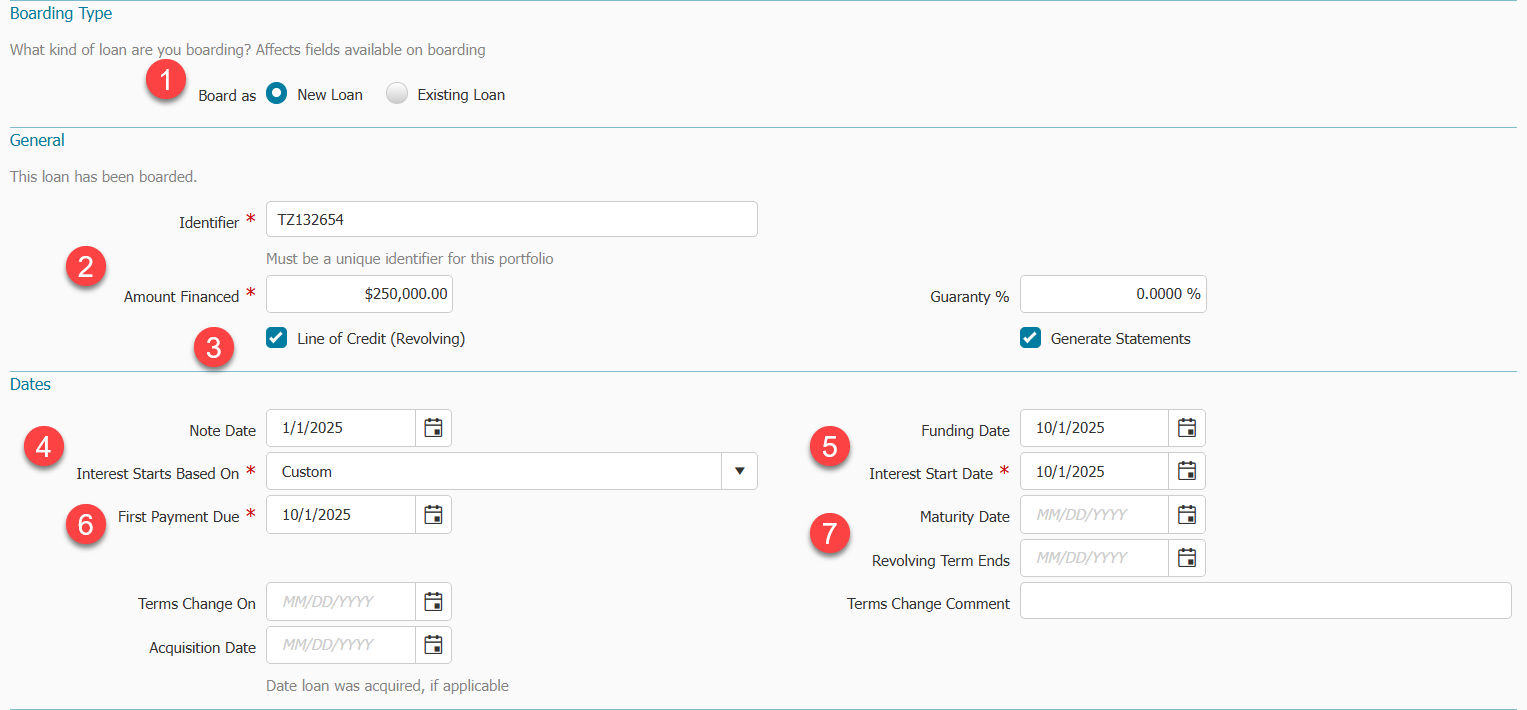

When boarding a New Line of Credit following these steps:

** NOTE - Make sure you have all Administrative Loan Type(s) and Payment Settings configured to accommodate unique Line of Credit requirements.

- Select New Loan

- Verify Amount Financed

- Select the checkbox for Line of Credit (Revolving)

- Determine what the Interest Starts Based On credentials should be:

- Custom - select any date you would like

- Funding Date - if you select Funding Date then the Funding Date field will be required

- Note Date - uses the date listed in the Note Date field

- Verify the Interest Start Date is what you are expecting it to be

- Enter the First Payment Due date

- Maturity Date and Revolving Term Ends are not required. However, if you have this information, you can enter them.

Special Note - If NO Maturity Date is provided, Ventures will automatically use a date 60 months from the payment calculation date as the maturity date when setting up a loan with Principal and Interest as the Payment Type

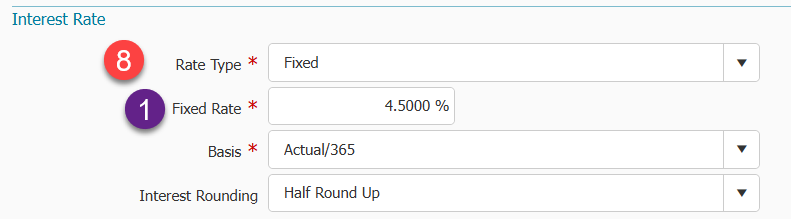

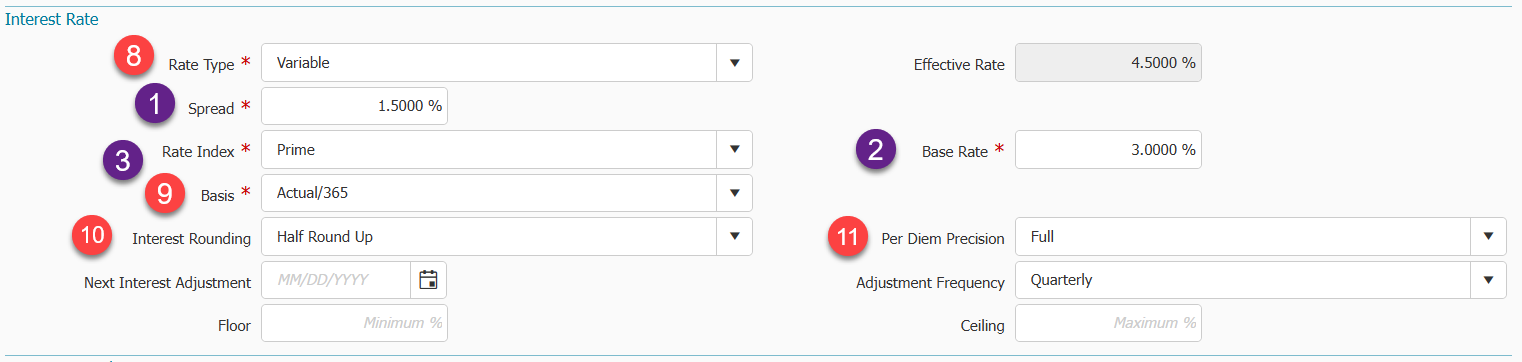

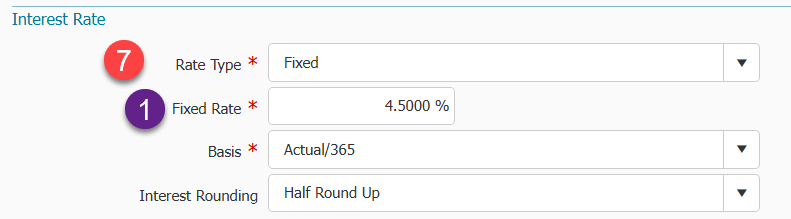

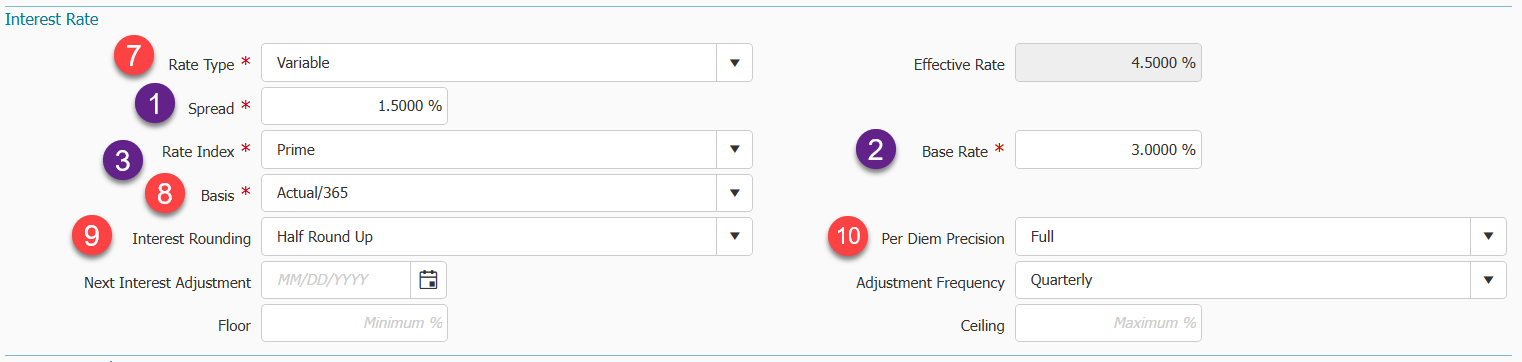

- Enter Interest Rate information starting with Rate Type:

- Fixed

Enter Fixed Rate Amount

- Variable

- Variable Rates Enter Spread

- Enter Base Rate

- Enter Rate Index

- Fixed

- Confirm your Basis is accurate

- Select Interest Rounding

- Half Round Up

- Floor

- Select Per Diem Precision

- Full

- Two Decimals

- Three Decimals

- Four Decimals

- Five Decimals

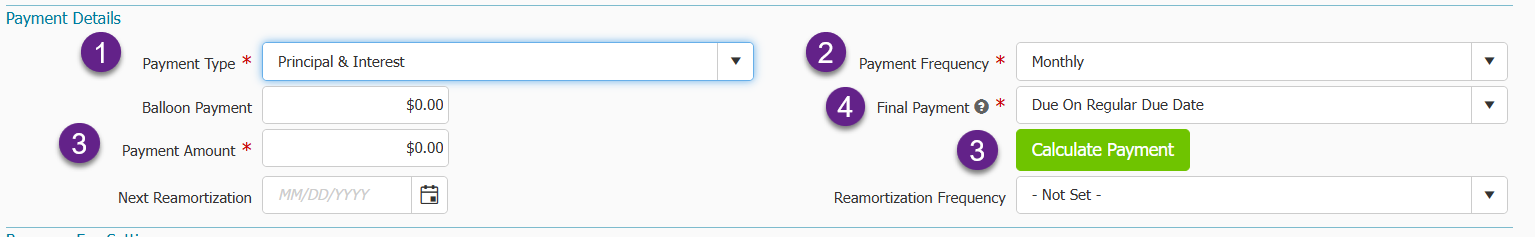

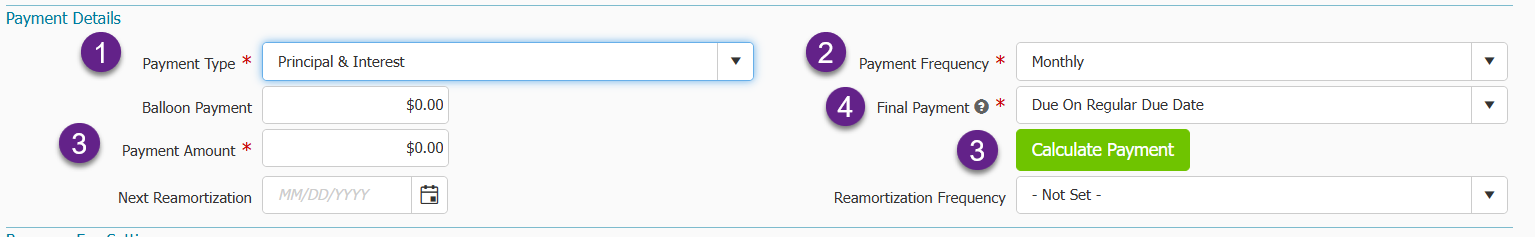

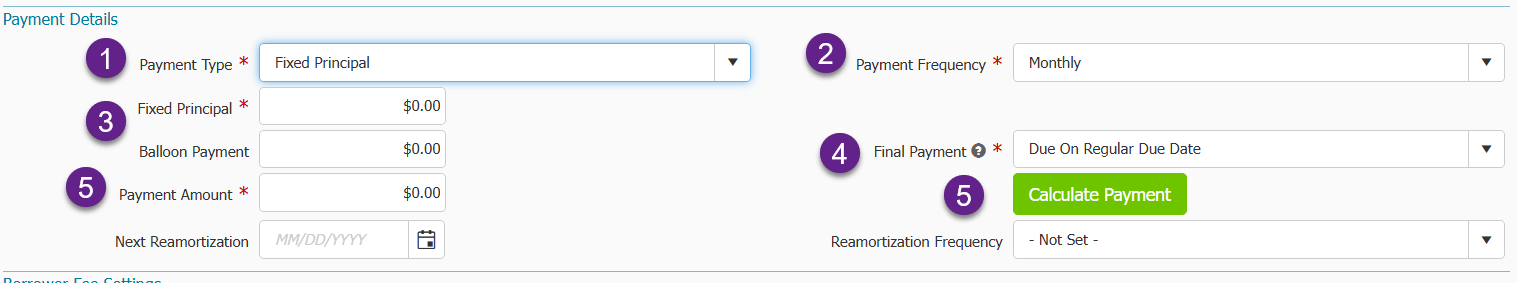

- Enter Payment Details starting with Payment Type

Note: Board the payment account as of the first payment type (ie if the first payment is Interest Only, and the remaining payments are P&I, you would board your payment account as an Interest Only Payment Type).- Principal & Interest

- Select Payment Type Principal & Interest

- Select Payment Frequency

- Enter Payment Amount OR use Calculate Payment

- Verify the Final Payment should be Due On Regular Due Date or change to Due On Maturity

- Optional Fields: Ballon Payment, Next Reamortization date and Reamortization Frequency

Note Reamortization fields are for internal use to track actions and do not perform any functions without lender's involvement.

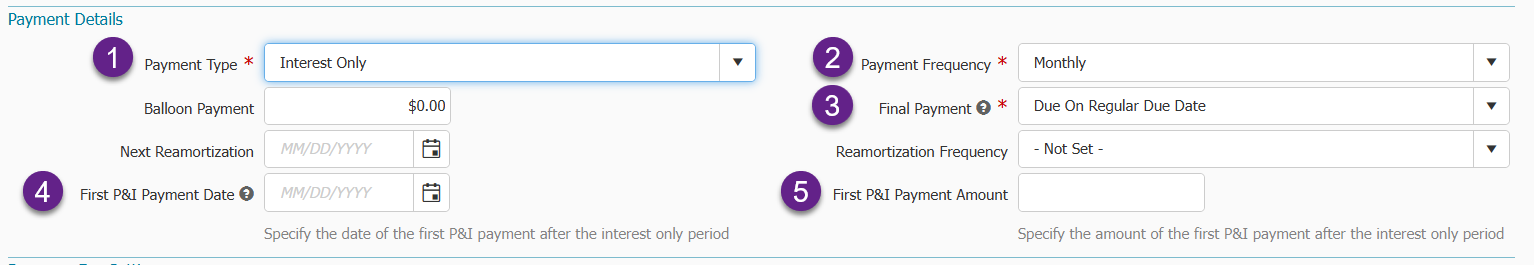

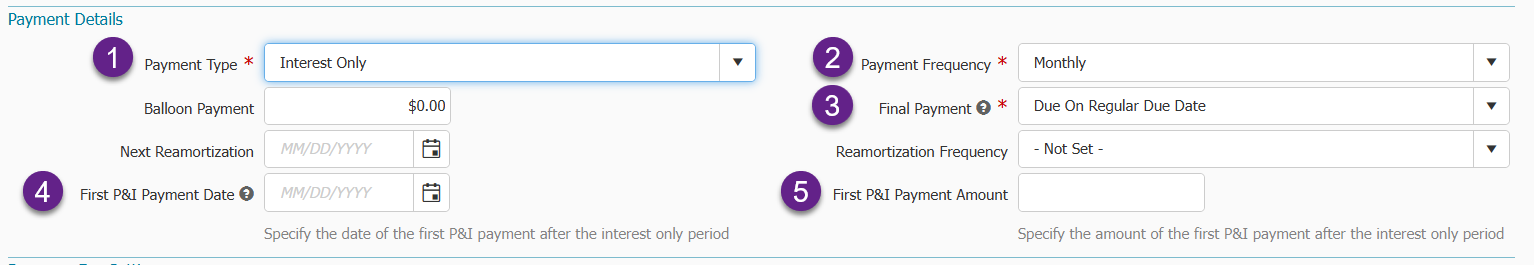

- Interest Only

- Select Payment Type Interest Only

- Enter Payment Frequency

- Verify the Final Payment should be Due On Regular Due Date or change to Due On Maturity

- Enter First P&I Payment Date - If you know when the First Principal & Interest payment day will be, enter it here

- Enter First P&I Payment Amount - If you know what the amount of the First Principal & Interest payment should be enter it here

- Optional Fields: Ballon Payment, Next Reamortization date and Reamortization Frequency

Note Reamortization fields are for internal use to track actions and do not perform any functions without lender's involvement.

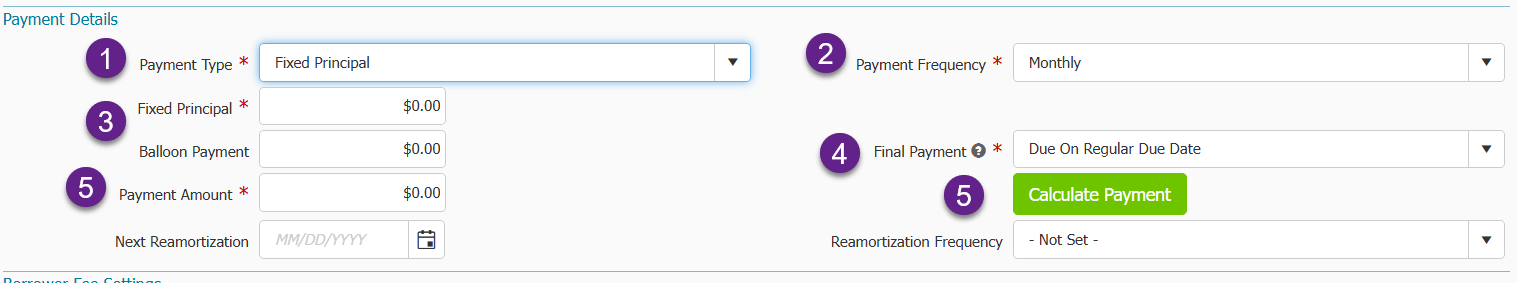

- Fixed Principal

- Enter Payment Type Fixed Principal

- Enter Payment Frequency

- Enter Fixed Principal Amount

- Verify the Final Payment should be Due On Regular Due Date or change to Due On Maturity

- Enter Payment Amount OR use Calculate Payment

- Optional Fields: Ballon Payment, Next Reamortization date and Reamortization Frequency

Note Reamortization fields are for internal use to track actions and do not perform any functions without lender's involvement.

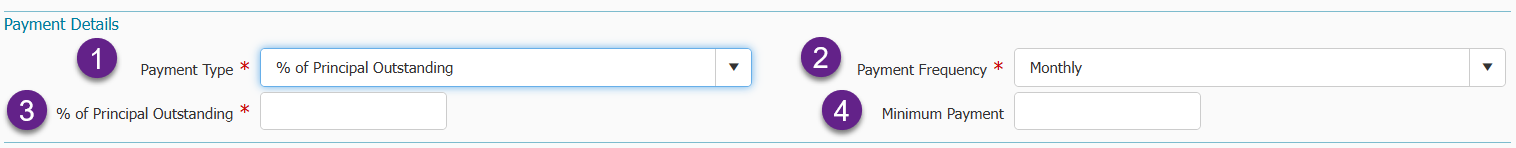

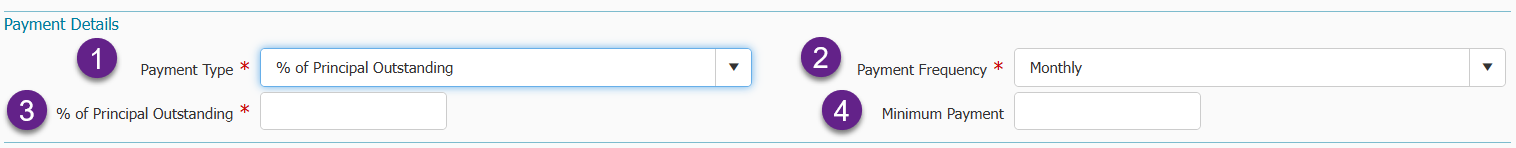

- % of Principal Outstanding

- Select Payment Type % of Principal Outstanding

- Select Payment Frequency

- Enter the % of Principal Outstanding

- Enter Minimum payment - if there is a minimum payment requirement use this field to list this requirement

- Principal & Interest

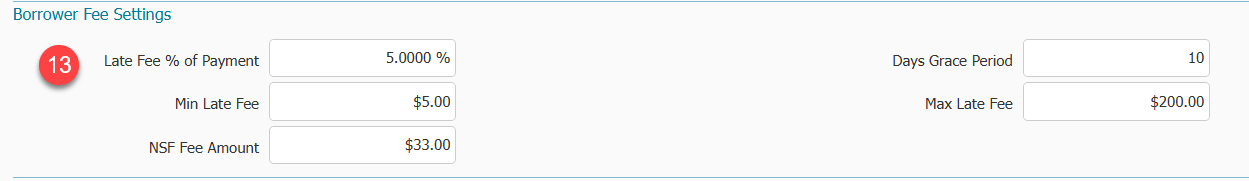

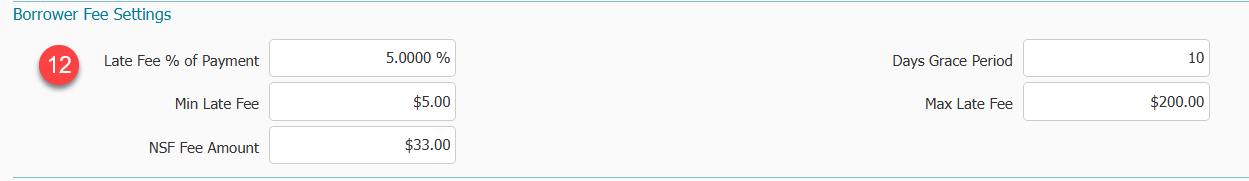

- Verify Borrower Fee Settings are what you would like to see

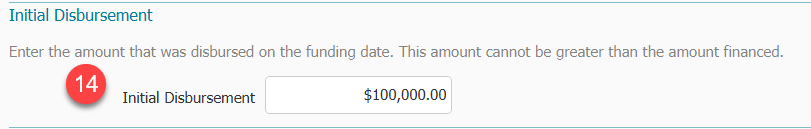

- Enter your Initial Disbursement

Note - This is no longer a required field for LOC and can be listed at a $0 balance

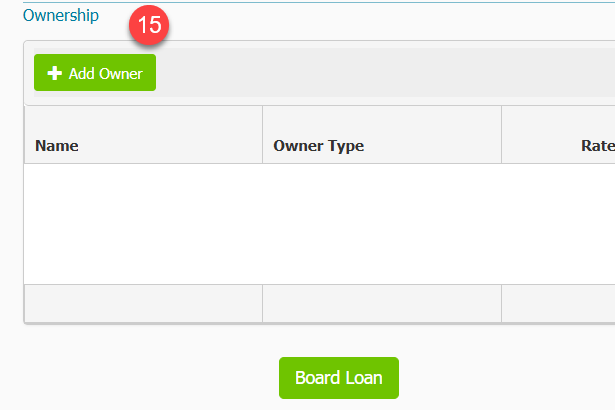

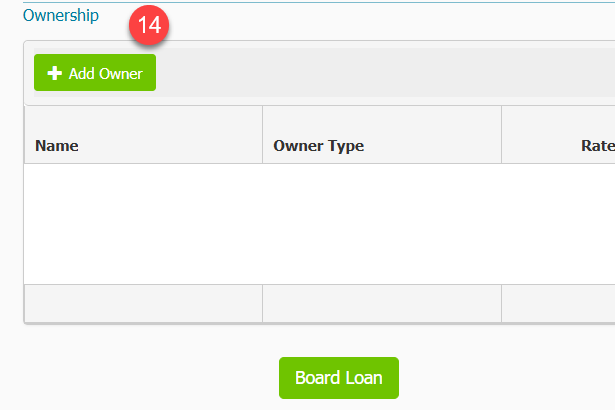

- Add any additional Owners/ Funding Sources that should be tracked for this loan

- Board Loan

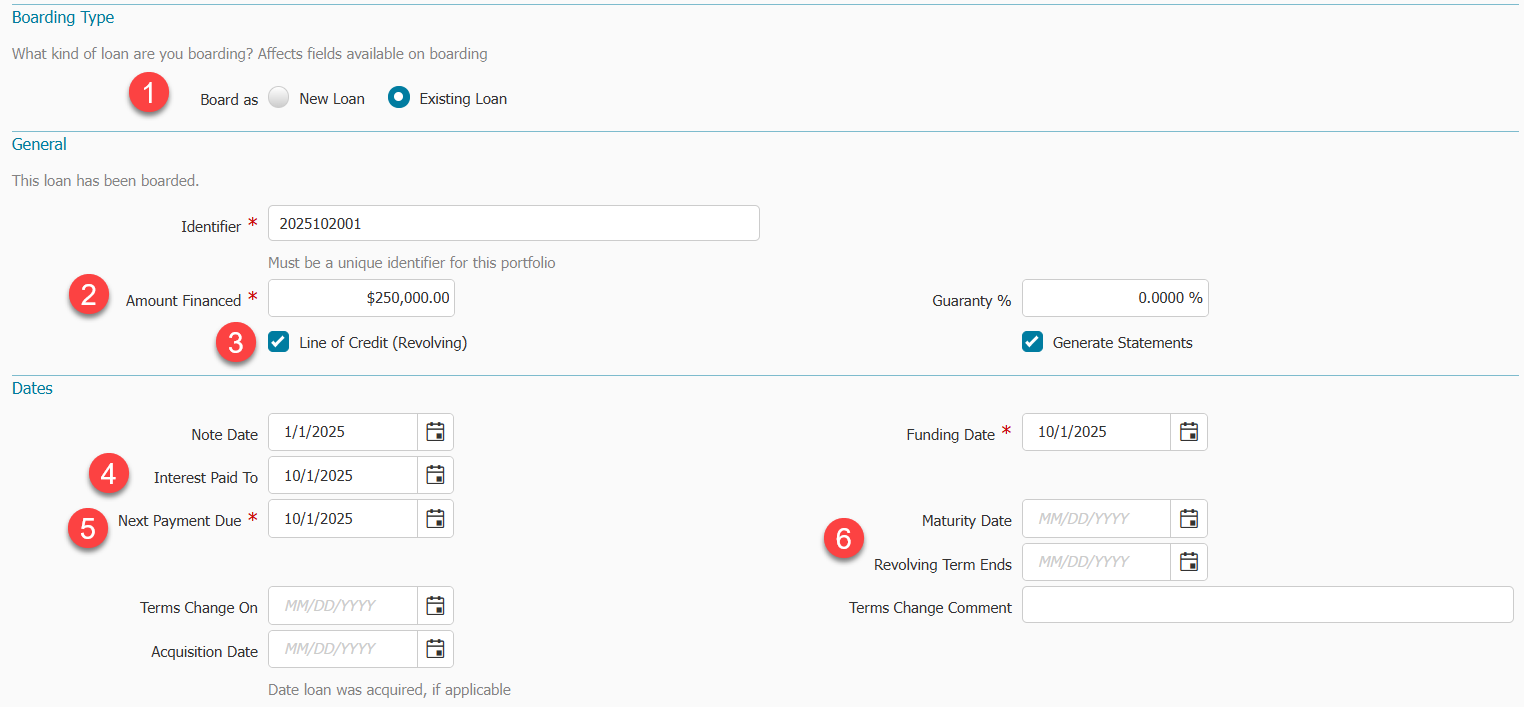

Boarding as Existing Line of Credit

Use this option when you have a Line of Credit that is already being processed in another system, and you want to board it from a point in time forward.

- Select Existing Loan

- Verify Amount Financed

- Select the checkbox for Line of Credit (Revolving)

- Confirm Interest Paid to Date

- Verify the Next Payment Due date

- Maturity Date and Revolving Term Ends are not required. However, if you have this information, you can enter them.

Special Note - If NO Maturity Date is provided, Ventures will automatically use a date 60 months from the payment calculation date as the maturity date when setting up a loan with Principal and Interest as the Payment Type

- Enter Interest Rate information starting with Rate Type:

- Fixed

Enter Fixed Rate Amount

- Variable

- Variable Rates Enter Spread

- Enter Base Rate

- Enter Rate Index

- Fixed

- Confirm your Basis is accurate

- Select Interest Rounding

- Half Round Up

- Floor

- Select Per Diem Precision

- Full

- Two Decimals

- Three Decimals

- Four Decimals

- Five Decimals

- Enter Payment Details starting with Payment Type

Note: Board the payment account as of the first payment type (ie if the first payment is Interest Only, and the remaining payments are P&I, you would board your payment account as an Interest Only Payment Type).- Principal & Interest

- Select Principal & Interest

- Select Payment Frequency

- Enter Payment amount OR Use Calculate Payment

- Verify the Final Payment should be Due On Regular Due Date or change to Due On Maturity

- Optional Fields: Ballon Payment, Next Reamortization date and Reamortization Frequency

Note Reamortization fields are for internal use to track actions and do not perform any functions without lender's involvement.

- Interest Only

- Select Interest Only

- Enter Payment Frequency

- Verify the Final Payment should be Due On Regular Due Date or change to Due On Maturity

- Enter First P&I Payment Date - If you know when the First Principal & Interest payment day will be, enter it here

- Enter First P&I Payment Amount - If you know what the amount of the First Principal & Interest payment should be enter it here

- Optional Fields: Ballon Payment, Next Reamortization date and Reamortization Frequency

Note Reamortization fields are for internal use to track actions and do not perform any functions without lender's involvement.

- Fixed Principal

- Enter Fixed Principal

- Enter Payment Frequency

- Enter Fixed Principal Amount

- Verify the Final Payment should be Due On Regular Due Date or change to Due On Maturity

- Enter Payment Amount OR Calculate Payment Amount

- Optional Fields: Ballon Payment, Next Reamortization date and Reamortization Frequency

Note Reamortization fields are for internal use to track actions and do not perform any functions without lender's involvement.

- % of Principal Outstanding

- Select % of Principal Outstanding

- Select Payment Frequency

- Enter the % of Principal Outstanding

- Enter Minimum payment - if there is a minimum payment requirement use this field to list this requirement

- Principal & Interest

- Verify Borrower Fee Settings are what you would like to see

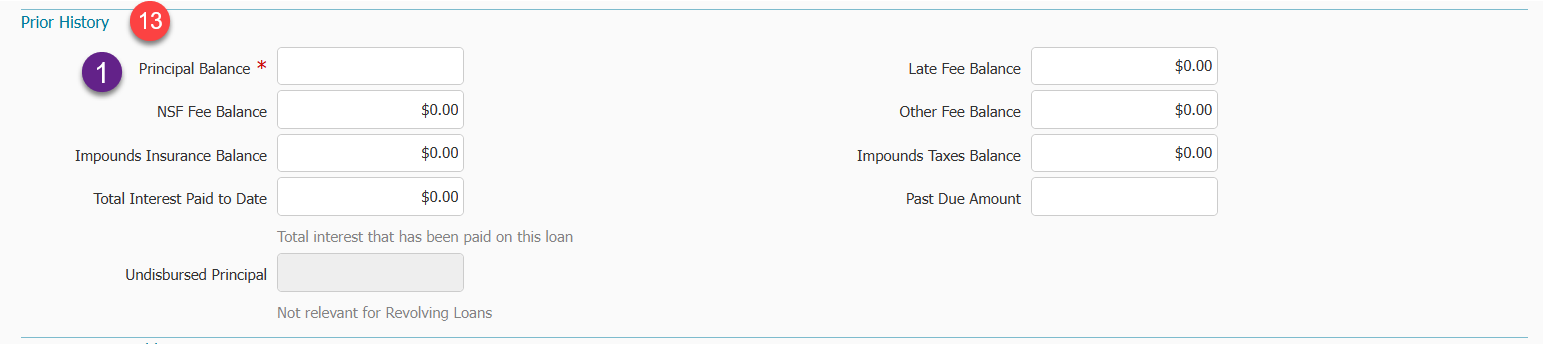

- Review the Prior History details

- Enter Principal Balance

- Enter other fee and past due amounts if necessary

- Add any additional Owners/ Funding Sources that should be tracked for this loan

- Board Loan