251

251

Lenders who need to produce a principal reduction report for GAP analysis have two available generation options: one through the Custom Reporting section and another through the Payments module.

Custom Reporting:

This option allows users to include additional data elements as needed. However, it has certain limitations — it can only generate reports for future periods, making timing critical to ensure accuracy. Reports should be run before any first-of-the-month payments are posted. Additionally, this version does not incorporate ownership details and performs calculations at the total loan level.

Payments > Reporting:

This option allows users to select any report date, including past dates, and calculate results moving forward. It also includes the ability to specify which owners to include in the report as well as other data. Both report options are described in more detail below.

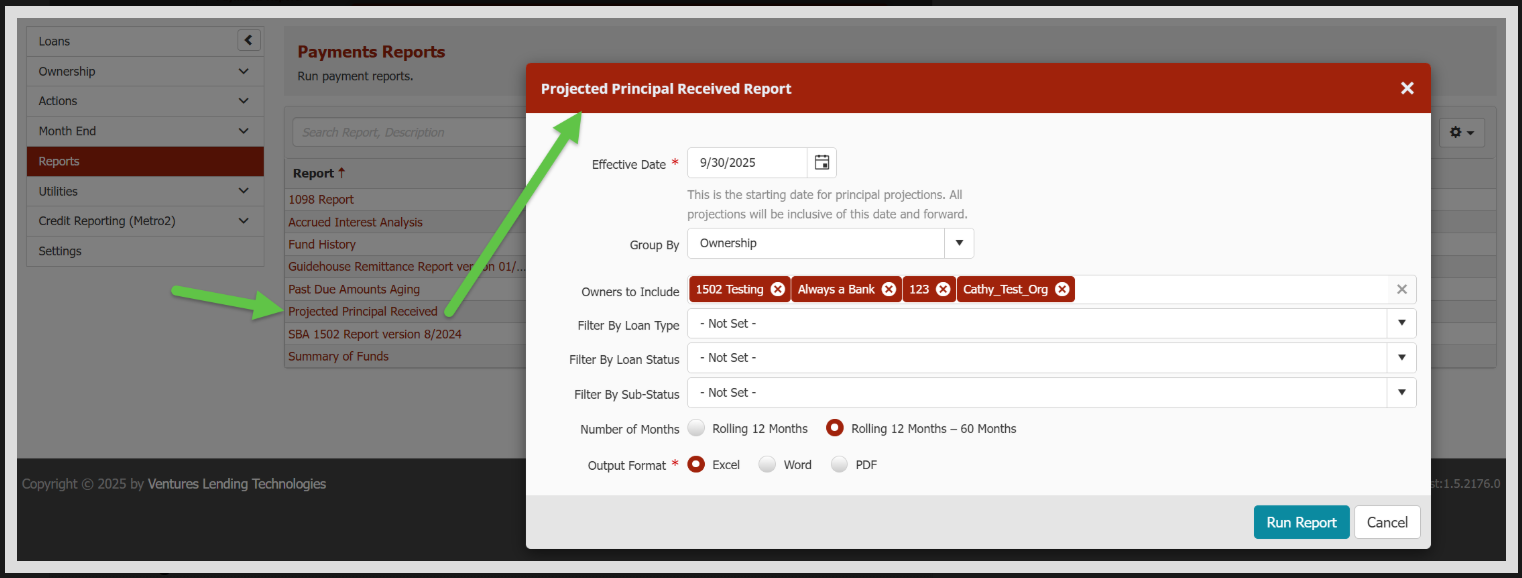

Payments > Reporting

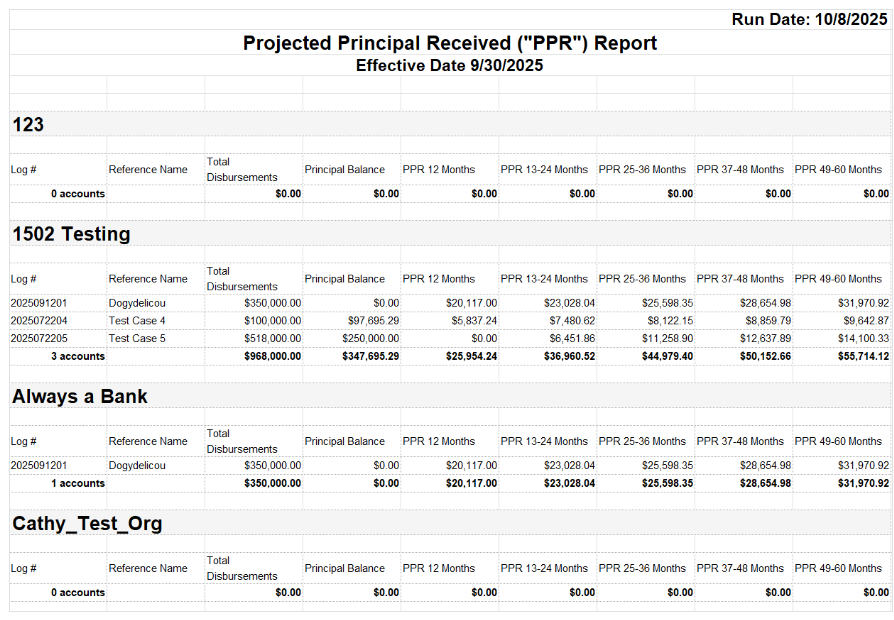

Projected Principal Report

Produce a report that projects principal to be received as of a certain effective date. The report data can:

- Use an effective date in the past

- Grouped by Owner/Investor

- Filtered by Loan Type, Loan Status, and Loan Sub-status

- Time frame adjusted between 1 year and each of the next 5 years

- Exported to Excel, Word or PDF

Here are some key aspects about how the report works:

-

Includes any principal expected to be received on that effective date

-

Does not show actual principal received (just projections)

-

Accounts with no transactions of any kind up to and including the effective date will not be included in the report (in case the effective date is in the past)

-

Accounts with $0 of expected principal throughout the period of the report will be filtered out

Custom Reporting

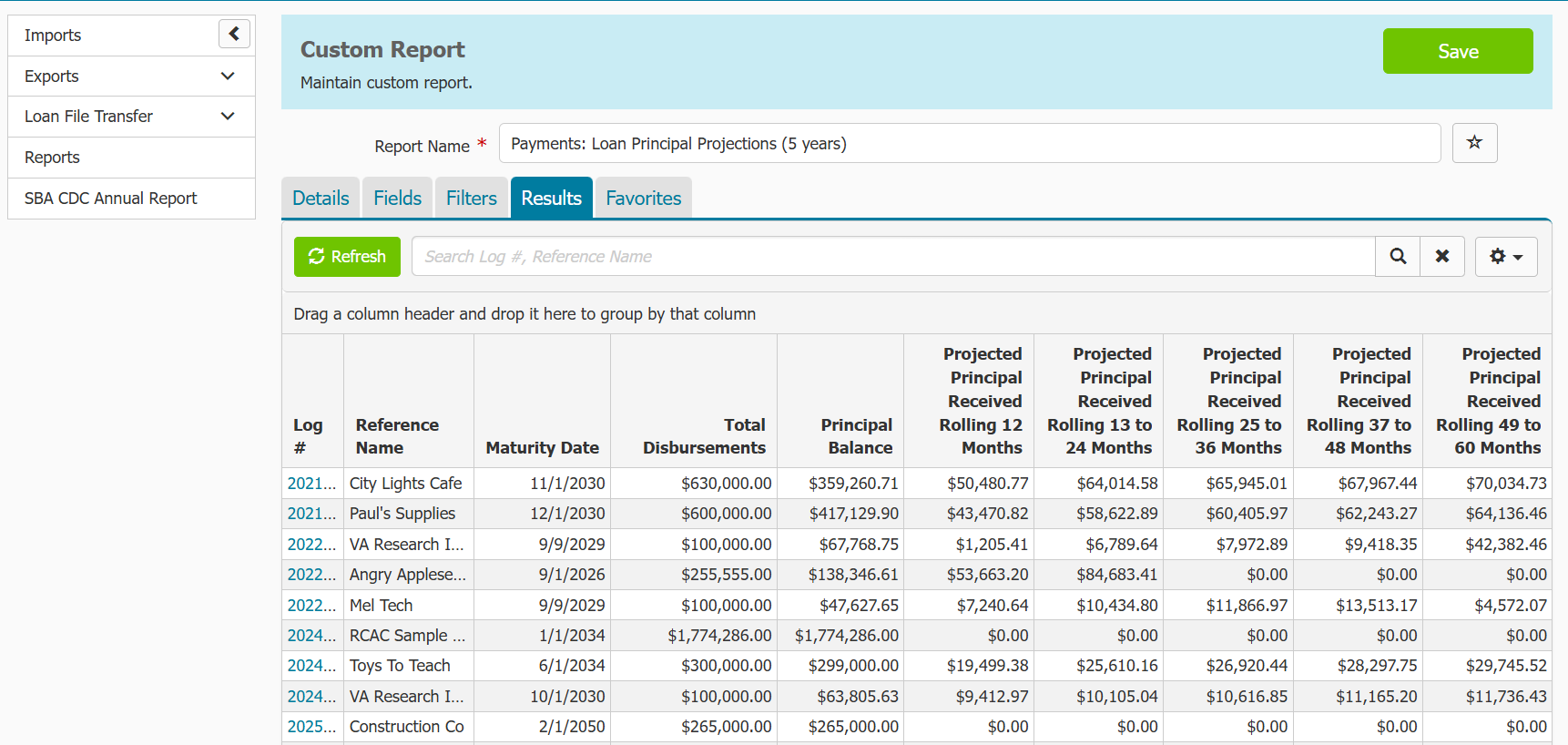

Loan Principal Projections

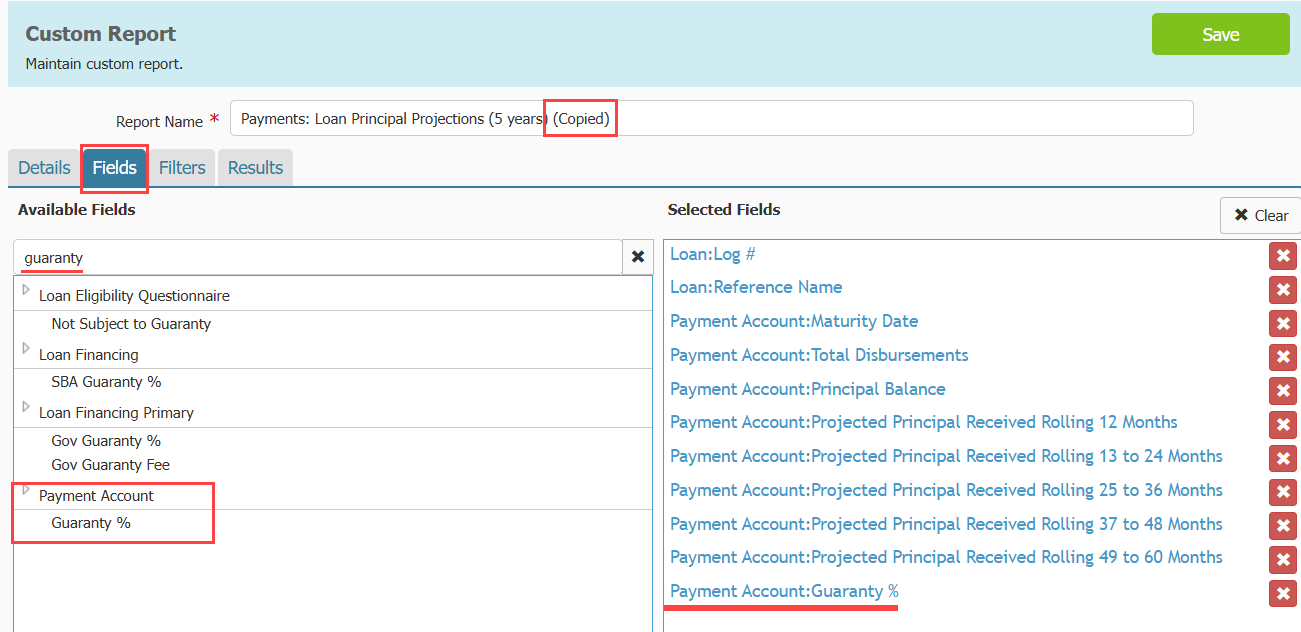

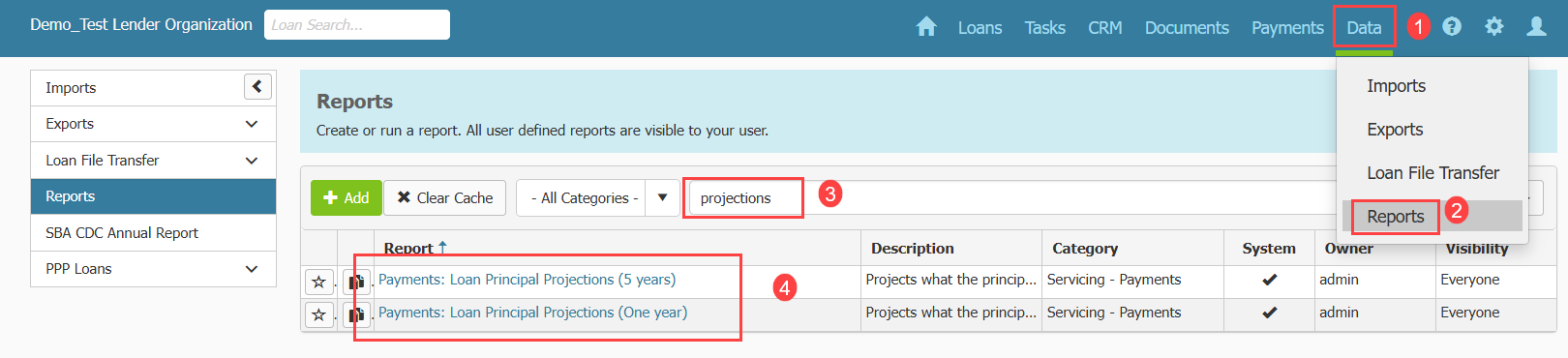

There are two options, based on either a one- or five-year period. This report(s) may be found by:

- Hovering over Data in the menu at the top of the screen. Click Reports in the submenu that appears.

- Use the search field to search for the report titled Payments: Loan Principal Projections

- You can choose from a one year or five year period for the report. Click the name of the report you want to run

Timing is critical to ensure accurate balances, users should run the report before any payments are posted at the beginning of the month.

Since this report reflects the full loan amount. If a lender needs to calculate only their portion, as defined in the ownership module, they will need to copy the report, add the Payment Account: Guaranty % field, and apply the appropriate calculation after exporting the data to Excel. Or we suggest using the report within the Payments>Reports area.

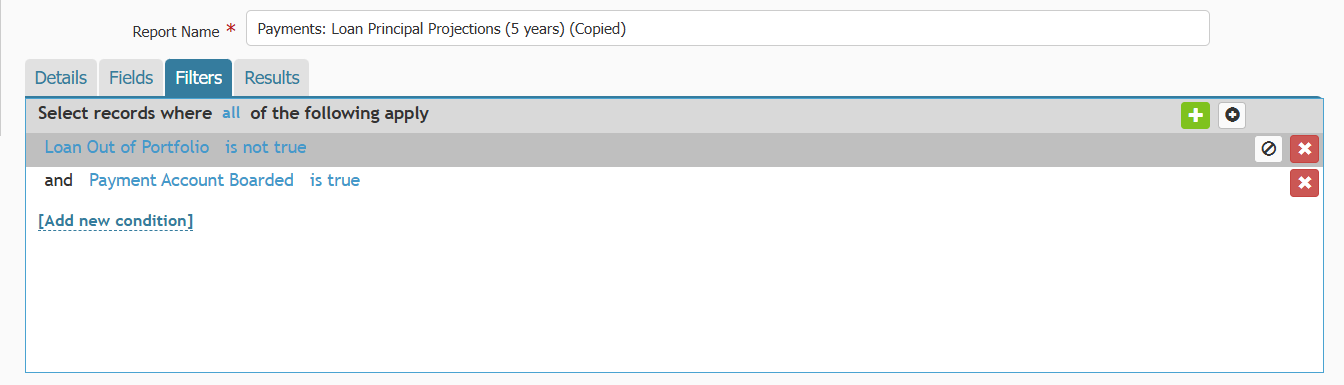

The criteria for loans to generate to this report are as follows:

- Loan Out of Portfolio is NOT true and

- Payment Account Boarded is true